Search Names & Symbols

DISCLAIMER:

Sunday, January 28, 2024

Tuesday, January 23, 2024

Thursday, January 18, 2024

Sunday, December 17, 2023

Saturday, November 4, 2023

Wednesday, August 16, 2023

When I see charts like this, they always catch my attention.

When I see charts like this, they always catch my attention.

The actors' strike has dealt a big blow to the stocks of companies involved in this sector.

Specifically, Paramount's stock is trading at low levels as its sales are $32 billion and it has a market capitalization of $10 billion.

⁉️⚠️ Unfortunately, the lending in these companies is quite high and needs special attention. They belong to the companies with high risk, without special dividend yields. They operate more like circular companies.

So it is good to take a position with logic without exaggeration and of course when they are at the bottom...

Monday, August 14, 2023

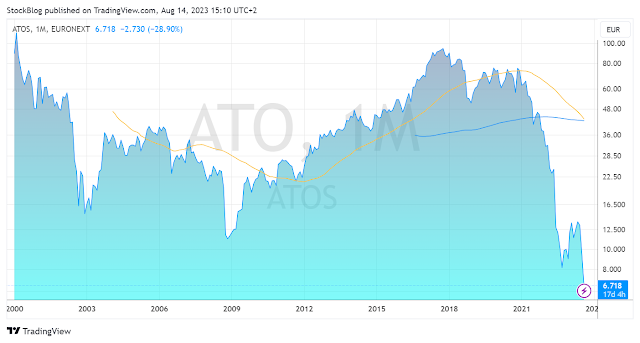

ATOS:The large French company that deals with cyber security, the internet and the cloud is essentially in bankruptcy

The large French company that deals with cyber security, the internet and the cloud is essentially in bankruptcy.

It has 11 billion in sales and a market capitalization of 700 million. Its debt is 5 billion and the treasury 2.5.

Some points to note:

👉 She is preparing to sell some of her assets which will give her two billion and reduce the debt by the same amount.

👉 It is preparing to split into two pieces and create two different companies.

No one knows if these changes will actually pay off and if they will happen. Essentially, however, the risk of buying at this price is limited due to the very large drop. Unless the company goes completely bankrupt, which would be a blow to the French economy, a small position could yield big profits.

In such cases, however, we forget our shares and consider the few 💸 lost. We look at them again in 2 years...

Sunday, August 13, 2023

Saturday, August 12, 2023

Wednesday, August 9, 2023

NLCP: TAKE A LOOK

NLCP: Take a look... by StockBlog on TradingView.com

What starts out nice, often ends in pain. NLCP stock owns and leases medical cannabis facilities. It started out crazy, but now it might be worth watching. It is in an industry with a future, but as you know, it is not worth giving a lot of money for the future, as it was in 2021, when it was listed on the stock market.

At the moment, however, her sizes look good. It has two million loans and 450 million in cash. It has a dividend yield of 12% paying 83% of its earnings in dividends, a P/E of 12 and a P/BV of 0.6. It trades five times its sales, but reasonable for a development company.

It is a relatively high-risk option with several possibilities of reversal if the figures improve in the future and the forecasts are verified. Now that much of the joy is deflating, it might be time to capitalize on the regret of the shareholders who bought at 32!

On the radar...